Transform Your Teaching

with AI-Powered Worksheets

With ReadTheory’s Instant Worksheet Builder, you can create engaging, grade-appropriate worksheets tailored to your students in minutes. Spark curiosity, save time, and empower critical thinking with AI-powered tools designed for teachers like you.

The World of Insurance Policies: An Eye-Opener

Life is unpredictable. One moment, everything's running smoothly; the next, an unforeseen event could turn it upside down. That's where insurance policies come into play. They act like a safety net, helping individuals manage risks and protect against potential financial losses.

Consider this scenario: Tom, an enthusiastic cyclist, bought a new, expensive bicycle. He also purchased an insurance policy, which will cover repair or replacement costs if his bike gets damaged or stolen. This way, Tom can enjoy his cycling adventures without worrying about potential financial burdens.

There are multiple types of insurance policies to cover different potential risks. Health insurance policies can cover medical expenses; car insurance can protect against costs related to car accidents or theft, and life insurance provides financial support to your loved ones in your absence.

The cost of these policies, known as the 'premium,' is calculated based on several risk factors. For example, a person with a history of health issues would likely pay a higher health insurance premium than someone with a clean bill of health. Similarly, a reckless driver would have to pay a higher car insurance premium than a careful one.

Insurance policies, in essence, are agreements between the policyholder and the insurance company. The policyholder pays premiums, and in return, the insurance company promises to cover specified losses up to a certain limit. In this way, insurance policies really do provide peace of mind in a world full of uncertainties.

Question 1

What does an insurance policy act as in the context of unforeseen events?

A safety net

A guarantee of no loss

A way to earn profit

A source of income

A credit scheme

Question 2

What is a 'premium' in relation to insurance policies?

The maximum amount the policy can cover

The cost of the insurance policy

The amount paid to the policyholder at the end of the policy term

The money paid by the insurance company when a claim is made

The interest earned on the insurance policy

Question 3

Based on the scenario presented, why did Tom purchase an insurance policy for his bicycle?

To make a profit from the insurance company

Because it was a legal requirement

To cover the cost of regular maintenance

To cover repair or replacement costs if the bike gets damaged or stolen

Because the insurance policy was cheap

Question 4

What factor could cause a person to pay a higher health insurance premium?

The person has a high income

The person lives in a safe neighborhood

The person has a history of health issues

The person is a careful driver

The person has a low-risk job

Question 5

True or False: A reckless driver would typically pay a lower car insurance premium than a careful driver.

True

False

Cannot be determined

Depends on the insurance company

Depends on the type of car

or share via

or share via

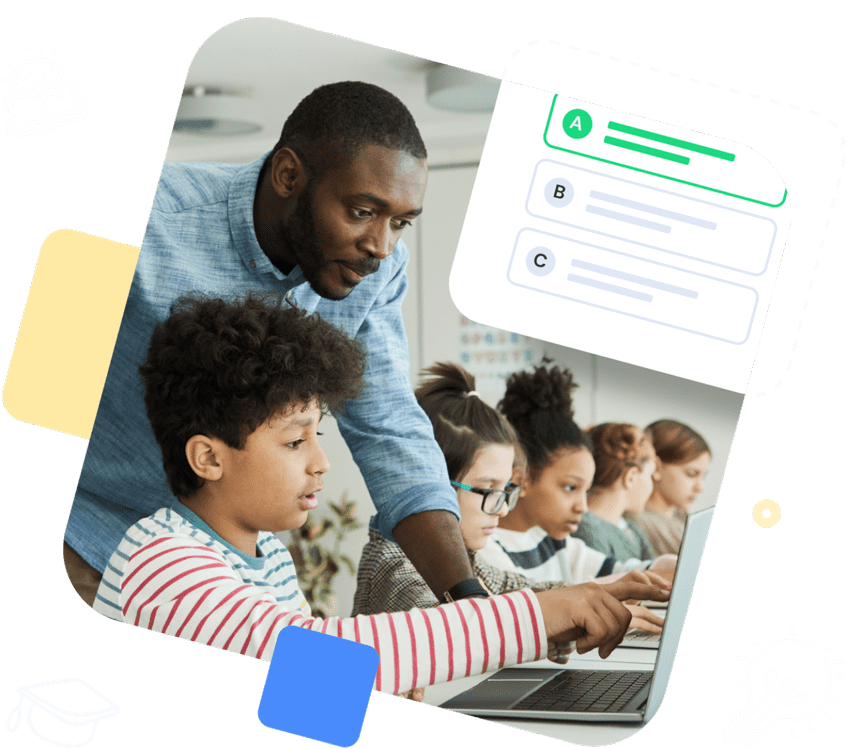

Assign the ReadTheory pretest to determine students' reading levels.

Why Teachers Love

Instant Worksheet Builder?

Tailored Content for Every Student

Craft worksheets with passages and multiple-choice questions customized to your chosen topic and grade level, ensuring relevance and engagement.

Save Hours

of Prep Time

Our AI, Lexi, generates complete worksheets—passages, questions, and answers—in minutes, freeing you to focus on teaching, not planning.

Standards-Aligned Learning

Every worksheet is designed to boost reading comprehension and critical thinking, aligning seamlessly with State Standards to help your students shine.

Personalized teaching

for personalized learning

Browse worksheets created and refined by educators using Lexi—your source for inspiration and ready-to-use resources.

ReadTheory is free for Teachers to use.

Join thousands of educators using ReadTheory for free. Sign up today and start creating in just minutes!