Transform Your Teaching

with AI-Powered Worksheets

With ReadTheory’s Instant Worksheet Builder, you can create engaging, grade-appropriate worksheets tailored to your students in minutes. Spark curiosity, save time, and empower critical thinking with AI-powered tools designed for teachers like you.

Max's Journey into the World of Financial Lenders

Once upon a time in Sunnyville, a young entrepreneur named Max had a brilliant idea for a startup. He needed to secure funding to turn his dream into reality. This led Max to the world of financial lenders, the entities that provide loans to individuals or businesses like Max's. Financial lenders come in various forms. Traditional banks, like Sunnyville’s Community Bank, are often the first stop. Banks offer various loans, including personal, business, and mortgage loans. Max learned that credit unions, like Sunnyville's Workers Credit Union, also lend money. Credit unions are not-for-profit organizations that provide services similar to banks but often have lower interest rates. Then, Max discovered online lenders. These digital platforms offer a quick, convenient way to secure funding. However, they sometimes have higher interest rates to offset the risk of lending to individuals and businesses they can't meet in person. Max realized that each type of lender had its pros and cons. Banks and credit unions were reliable but had a lengthy approval process, while online lenders were quick but often had higher interest rates. Max decided to carefully compare his options before securing a loan. Max's journey into the world of financial lenders taught him an important lesson about financial responsibility. He understood that borrowing money is not a decision to be taken lightly. It is crucial to seek out reputable lenders, understand the loan's terms, and ensure it can be repaid timely.

Question 1

Who is the main character in the story?

Sunnyville

Workers Credit Union

Community Bank

Max

Question 2

What is the main disadvantage of online lenders according to the text?

They do not provide loans

They are not available in Sunnyville

They always have higher interest rates

Their approval process is lengthy

They can't meet borrowers in person, so often have higher interest rates

Question 3

What was the lesson Max learned from his journey into the world of financial lenders?

Borrowing money is a decision to be taken lightly

Seek out unreliable lenders

Understand the loan's terms and ensure it can't be repaid timely

Borrowing money is not a decision to be taken lightly, it's crucial to seek out reputable lenders, understand the loan's terms, and ensure it can be repaid timely

Online lenders have the best interest rates

Question 4

What does the term 'financial lenders' refer to in the context of this text?

Entities that only provide personal loans

Entities that only fund startups

Entities that provide loans to individuals or businesses

Entities that do not charge interest rates

Entities that provide loans only to Max

Question 5

What types of loans do traditional banks like Sunnyville’s Community Bank offer?

Only personal loans

Only business loans

Only mortgage loans

Personal, business, and mortgage loans

or share via

or share via

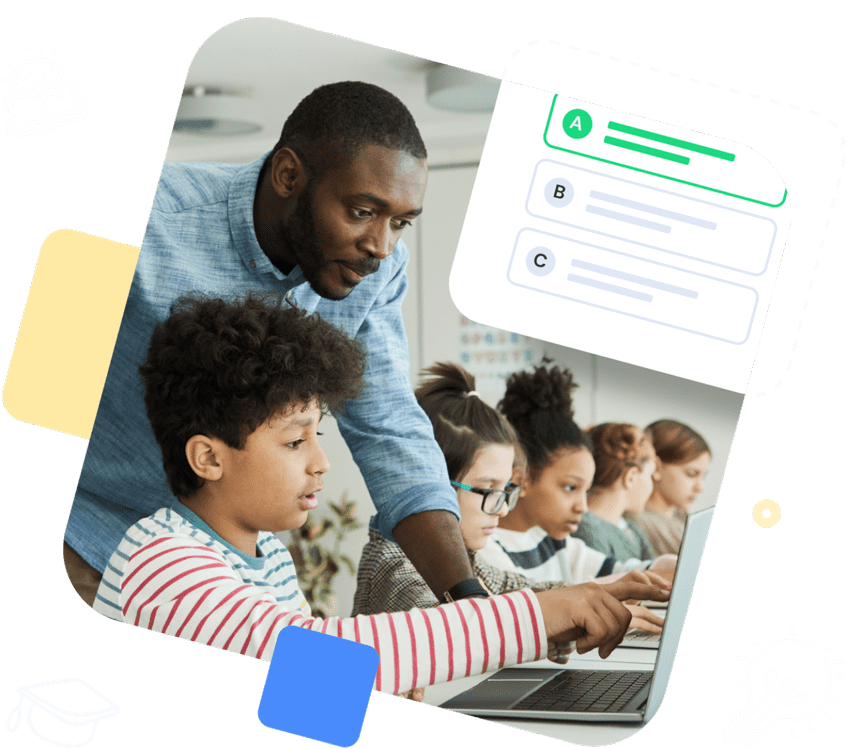

Assign the ReadTheory pretest to determine students' reading levels.

Why Teachers Love

Instant Worksheet Builder?

Tailored Content for Every Student

Craft worksheets with passages and multiple-choice questions customized to your chosen topic and grade level, ensuring relevance and engagement.

Save Hours

of Prep Time

Our AI, Lexi, generates complete worksheets—passages, questions, and answers—in minutes, freeing you to focus on teaching, not planning.

Standards-Aligned Learning

Every worksheet is designed to boost reading comprehension and critical thinking, aligning seamlessly with State Standards to help your students shine.

Personalized teaching

for personalized learning

Browse worksheets created and refined by educators using Lexi—your source for inspiration and ready-to-use resources.

ReadTheory is free for Teachers to use.

Join thousands of educators using ReadTheory for free. Sign up today and start creating in just minutes!