Transform Your Teaching

with AI-Powered Worksheets

With ReadTheory’s Instant Worksheet Builder, you can create engaging, grade-appropriate worksheets tailored to your students in minutes. Spark curiosity, save time, and empower critical thinking with AI-powered tools designed for teachers like you.

John's Journey to Understanding ETFs

John had always been interested in finance. He loved hearing about the rise and fall of stocks, and he was intrigued by the idea of investing his money in a way that could potentially grow over time. One day, while researching investment options, he came across something he had never heard of before: ETFs. ETF, John learned, stood for Exchange Traded Fund. It was a type of investment fund and exchange-traded product, traded on stock exchanges. ETFs held assets like stocks, bonds, or commodities, and they aimed to track the performance of specific indexes. As he delved deeper, John discovered that ETFs were popular for several reasons. They offered diversification, could be bought or sold at any time during the trading day, and usually had lower fees compared to mutual funds. This made them an attractive option for many investors. However, as with all investments, ETFs carried risks. The value of an ETF could go down, potentially resulting in a loss of money. Additionally, while ETFs tried to track an index, they might not always do so perfectly because of fees and other factors. By the end of his research, John was excited by the potential of ETFs. He knew they were just one of many investment tools available, but he appreciated their unique features. As he closed his laptop, he felt a step closer to becoming a confident investor.

Question 1

What does ETF stand for in the context of finance?

Exchange Traded Fund

Economic Trade Finance

Equity Total Fund

Efficient Transfer Facility

Exponential Trading Factor

Question 2

What is one reason ETFs are popular among investors?

They can only be bought or sold at specific times

They have higher fees compared to mutual funds

They offer diversification

They guarantee profits

They do not carry any risks

Question 3

What is a risk associated with investing in ETFs?

The value of an ETF can never go down

ETFs can only hold stocks

The value of an ETF could go down, potentially resulting in a loss of money

ETFs always track an index perfectly

ETFs cannot be sold during the trading day

Question 4

What type of assets can ETFs hold?

Only stocks

Only bonds

Only commodities

Stocks, bonds, or commodities

None of the above

Question 5

Why might ETFs not always track an index perfectly?

Because of the investor's personal preferences

Because of legal restrictions

Because of fees and other factors

Because of the time of day

None of the above

or share via

or share via

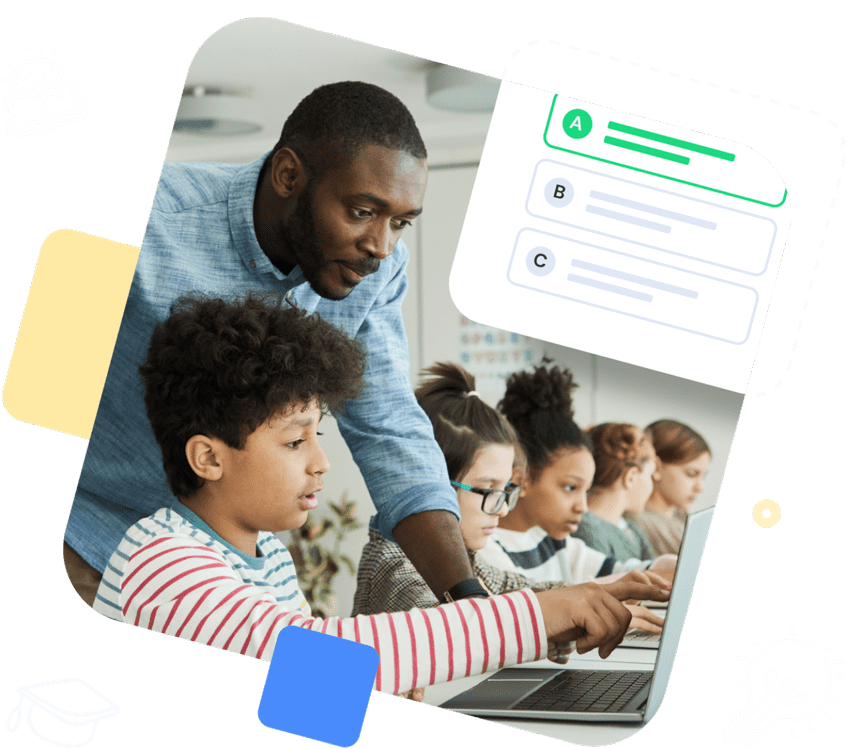

Assign the ReadTheory pretest to determine students' reading levels.

Why Teachers Love

Instant Worksheet Builder?

Tailored Content for Every Student

Craft worksheets with passages and multiple-choice questions customized to your chosen topic and grade level, ensuring relevance and engagement.

Save Hours

of Prep Time

Our AI, Lexi, generates complete worksheets—passages, questions, and answers—in minutes, freeing you to focus on teaching, not planning.

Standards-Aligned Learning

Every worksheet is designed to boost reading comprehension and critical thinking, aligning seamlessly with State Standards to help your students shine.

Personalized teaching

for personalized learning

Browse worksheets created and refined by educators using Lexi—your source for inspiration and ready-to-use resources.

ReadTheory is free for Teachers to use.

Join thousands of educators using ReadTheory for free. Sign up today and start creating in just minutes!