Transform Your Teaching

with AI-Powered Worksheets

With ReadTheory’s Instant Worksheet Builder, you can create engaging, grade-appropriate worksheets tailored to your students in minutes. Spark curiosity, save time, and empower critical thinking with AI-powered tools designed for teachers like you.

Crowdfunding: The Power of Collective Investment Funding decisions and the role of trust: a qualitative study of reward-based crowdfunding in the creative industries

This study examines the role of trust in influencing funder decision-making processes in crowdfunding campaigns in the creative industries. We focus on the reward-based crowdfunding (RBCF) model because of its popularity among creators in the creative industries. The RBCF model differs from the equity-based crowdfunding model in the nature of exchanges. While individual investors in equity crowdfunding receive shares in exchange for their investments, funders in RBCF campaigns receive rewards or perks according to contribution levels. For example, organizations in the creative industries offer rewards comprised of various commercial products, such as exhibit tickets and live performances and project-related products that connect funders with their brands (Thurridl and Kamleitner, 2016). Compared to other crowdfunding campaigns, some studies (e.g. Mollick, 2014) argue that investing in RBCF in the creative industries has potential risks such as undeveloped products (Zvilichovsky et al., 2015), delivery delays and other deviations from campaign promises (Appio et al., 2020). Funders also face challenges in assessing the project’s actual value due to missing benchmark and unbiased information about the reputation and legitimacy of creative organizations. Unique characteristics of the creative industries also lead to further complexities that increase the risks. For example, risk might rise in collaborations as creative organizations often instigate innovative projects in cooperation with diverse entities (Huxham and Vangen, 2005; Khaire, 2017) and firms of all sizes. Consequently, RBCF creators must ensure that they are perceived as trustworthy as they seek to fulfill their campaign promises.

Question 1

What is crowdfunding?

A type of loan from a bank

An investment strategy involving stocks

A way to raise funds by gathering small amounts from many people, typically over the internet

A business model for non-profits

A method of fundraising exclusively for artists

Question 2

What is the key difference between reward-based and equity-based crowdfunding?

Reward-based crowdfunding is only for non-profits

Reward-based crowdfunding offers a product or service in return for a donation, while equity-based crowdfunding offers part ownership of a company

Equity-based crowdfunding is illegal

Equity-based crowdfunding guarantees returns

There's no difference

Question 3

What does the success of crowdfunding campaigns like the Pebble E-Paper Watch demonstrate?

That smartwatches are the future

That crowdfunding is a guaranteed way to raise funds

That Kickstarter is the best crowdfunding platform

The potential of crowdfunding as a means to raise large sums from many contributors

That all crowdfunding campaigns raise over $10 million

Question 4

What risks are associated with crowdfunding?

Projects can fail and contributed money can be lost

Crowdfunding is always a scam

Only non-profits can lose money in crowdfunding

There are no risks associated with crowdfunding

Crowdfunding risks are only financial

Question 5

What is the significance of crowdfunding in the financial landscape?

It has no impact

It undermines traditional banking

It is a fad that will soon pass

It democratizes capital, allowing anyone with an internet connection to become an investor

Crowdfunding only benefits the rich

or share via

or share via

Assign the ReadTheory pretest to determine students' reading levels.

Why Teachers Love

Instant Worksheet Builder?

Tailored Content for Every Student

Craft worksheets with passages and multiple-choice questions customized to your chosen topic and grade level, ensuring relevance and engagement.

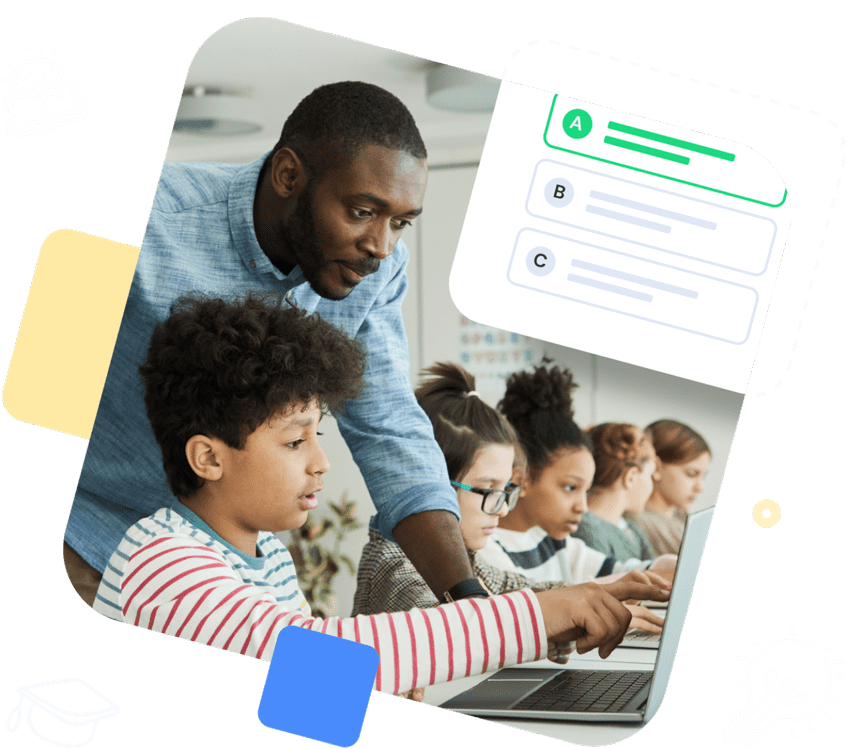

Save Hours

of Prep Time

Our AI, Lexi, generates complete worksheets—passages, questions, and answers—in minutes, freeing you to focus on teaching, not planning.

Standards-Aligned Learning

Every worksheet is designed to boost reading comprehension and critical thinking, aligning seamlessly with State Standards to help your students shine.

Personalized teaching

for personalized learning

Browse worksheets created and refined by educators using Lexi—your source for inspiration and ready-to-use resources.

ReadTheory is free for Teachers to use.

Join thousands of educators using ReadTheory for free. Sign up today and start creating in just minutes!