Transform Your Teaching

with AI-Powered Worksheets

With ReadTheory’s Instant Worksheet Builder, you can create engaging, grade-appropriate worksheets tailored to your students in minutes. Spark curiosity, save time, and empower critical thinking with AI-powered tools designed for teachers like you.

Crowdfunding: Powering Innovation and Community Involvement

Introduction

This study examines the role of trust in influencing funder decision-making processes in crowdfunding campaigns in the creative industries. We focus on the reward-based crowdfunding (RBCF) model because of its popularity among creators in the creative industries. The RBCF model differs from the equity-based crowdfunding model in the nature of exchanges. While individual investors in equity crowdfunding receive shares in exchange for their investments, funders in RBCF campaigns receive rewards or perks according to contribution levels. For example, organizations in the creative industries offer rewards comprised of various commercial products, such as exhibit tickets and live performances and project-related products that connect funders with their brands (Thurridl and Kamleitner, 2016). Compared to other crowdfunding campaigns, some studies (e.g. Mollick, 2014) argue that investing in RBCF in the creative industries has potential risks such as undeveloped products (Zvilichovsky et al., 2015), delivery delays and other deviations from campaign promises (Appio et al., 2020). Funders also face challenges in assessing the project’s actual value due to missing benchmark and unbiased information about the reputation and legitimacy of creative organizations. Unique characteristics of the creative industries also lead to further complexities that increase the risks. For example, risk might rise in collaborations as creative organizations often instigate innovative projects in cooperation with diverse entities (Huxham and Vangen, 2005; Khaire, 2017) and firms of all sizes. Consequently, RBCF creators must ensure that they are perceived as trustworthy as they seek to fulfill their campaign promises.

To mitigate uncertainty and risk associated with funding decisions, funders are often highly involved in the project development and regard themselves as partners (Zheng et al., 2016). They are actively engaged by researching the project and the organizations as a part of the trust development. Previous studies (Suddaby et al., 2015) acknowledge the importance of trust in funders’ decisions. In traditional crowdfunding mechanisms, trust is difficult to be built and even more difficult in the context of RBCF (Balboni et al., 2014). Funders in the creative industries tend to be amateurs rather than professionals (Mollick and Nanda, 2015; Hoegen et al., 2018). Hence, the judgments of these funders are informed by exchanges on social media, as well as other online and offline sources (Shneor and Munim, 2019; Chan et al., 2020). Despite the importance of trust, scholarly knowledge about trust development in online environment is still lacking (Liang et al., 2019). It is thus worthwhile to investigate the following question: how is trust developed to support funders’ decision-making process in RBCF in the creative industries?

Using various data sources, including observation, interviews with funders and data from social media and online discussion, this study contributes to the development of knowledge on crowdfunding literature twofold. First, we investigate how the decision to support RBCF can be seen as a result of trust development. Many studies have identified several success factors that can entice funders to contribute to RBCF campaigns: compelling storylines (Anglin et al., 2018), effective video narratives (Mollick, 2014), campaign interactions (Mollick and Nanda, 2015), displays of enthusiasm alongside the professional backgrounds of creators (Hui et al.,2014; Cardon et al., 2017) and strategic reward options (Thurridl and Kamleitner, 2016). Studies also focus on themes such as funders’ motivations (e.g. Gerber et al., 2012), fundraising performance (e.g. Belleflamme et al., 2014) and project implementation (e.g. Mollick, 2014). Unfortunately, this extant research has not thoroughly investigated the foundations of these factors, such as how funders use online profile and interaction with RBCF creators to develop trust which later influences the decision-making process (Hoegen et al., 2018; Zheng et al., 2016). Moreover, this study focuses on trust because of the uncertainties and information asymmetries inherent in an online context such as crowdfunding platforms (Beldad et al., 2010; Jaiswal et al., 2018).

Second, we contribute to the understanding of the practice and trust management of crowdfunding campaigns. As this study shows, funders mitigate risk by developing a trust mechanism through online interaction. Hence, we contribute to the debate in the field by bringing a new perspective where funders are seen as active players through direct and indirect online engagement with the RBCF creators. This perspective contrasts with previous studies, mainly focusing on the creators’ responsibility to build a trustworthy image through narrative and traditional communication channel. As a result, our findings also help RBCF creators in the creative industries to develop strategies to attract support.

The paper is structured as follows. We first present a review of the relevant literature and the conceptual background and fundamental concepts of this study. We then describe our research design and methods, followed by our key findings. Finally, we conclude with a discussion of the theoretical contributions, practical and managerial implications, and limitations and future research opportunities afforded by this study.

Question 1

What is crowdfunding?

A digital fundraising method

An equity share system

A type of loan

An internet based auction

An online shopping platform

Question 2

What was unique about the Pebble's fundraising campaign?

It was the first smartwatch

It was an unsuccessful campaign

They exceeded their goal by a significant margin

They didn't use crowdfunding

They only asked for $10,000

Question 3

What does rewards-based crowdfunding entail?

Donors receive a product or service in return

Donors get an equity share

Donors don't expect anything in return

Donors receive a tax break

Donors are repaid with interest

Question 4

What is one risk associated with crowdfunding?

The internet could crash

Backers could not receive their promised rewards

The project could become too successful

The government could interfere

There are no risks

Question 5

What impact has crowdfunding had on entrepreneurship and innovation?

It has made it more difficult

It has had no impact

It has made it more expensive

It has democratized fundraising

It has led to less innovation

or share via

or share via

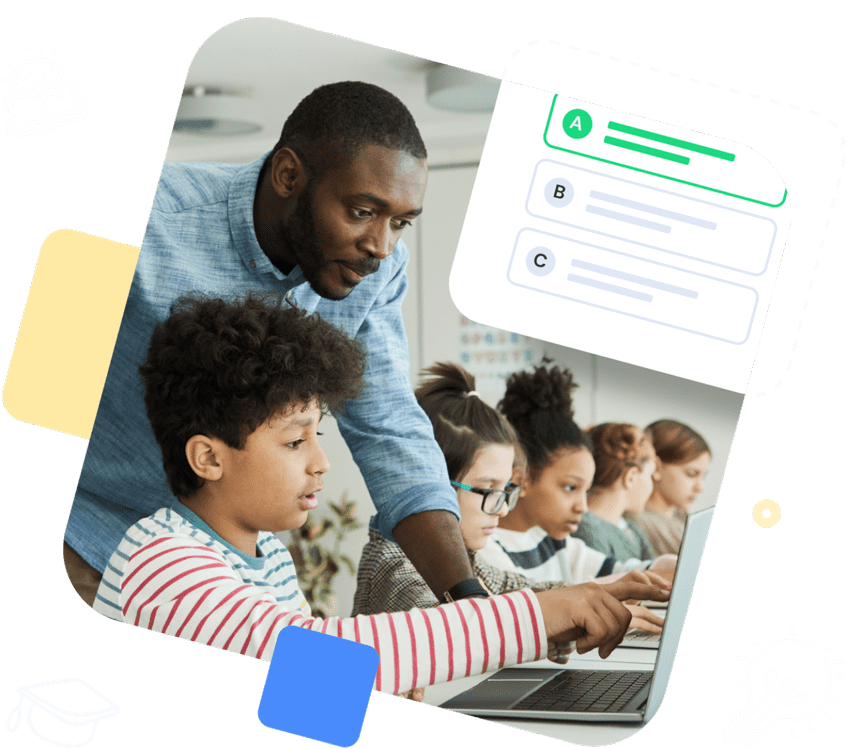

Assign the ReadTheory pretest to determine students' reading levels.

Why Teachers Love

Instant Worksheet Builder?

Tailored Content for Every Student

Craft worksheets with passages and multiple-choice questions customized to your chosen topic and grade level, ensuring relevance and engagement.

Save Hours

of Prep Time

Our AI, Lexi, generates complete worksheets—passages, questions, and answers—in minutes, freeing you to focus on teaching, not planning.

Standards-Aligned Learning

Every worksheet is designed to boost reading comprehension and critical thinking, aligning seamlessly with State Standards to help your students shine.

Personalized teaching

for personalized learning

Browse worksheets created and refined by educators using Lexi—your source for inspiration and ready-to-use resources.

ReadTheory is free for Teachers to use.

Join thousands of educators using ReadTheory for free. Sign up today and start creating in just minutes!