Transform Your Teaching

with AI-Powered Worksheets

With ReadTheory’s Instant Worksheet Builder, you can create engaging, grade-appropriate worksheets tailored to your students in minutes. Spark curiosity, save time, and empower critical thinking with AI-powered tools designed for teachers like you.

The Tale of Taxes: Understanding Your Civic Duty

Taxes - a word that often conjures up images of complicated forms and money deducted from paychecks. But what exactly are taxes, and why are they so integral to a functioning society? Taxes are mandatory payments to the government, used to finance public goods and services. These range from highways and schools to social security and defense. The concept of taxation is not new. Its roots can be traced back to the founding of our nation, with events like the Boston Tea Party and the slogan "No taxation without representation," symbolizing the fight against unjust taxes by the British. In the U.S., there are several types of taxes. Income tax, paid on the money you earn; sales tax, added to the price of goods and services; and property tax, paid on the value of owned property. These taxes form a significant chunk of government revenue and directly impact our daily lives. To understand the true impact of taxes, consider the example of the Hoover Dam. Completed in 1936, it was a public works project funded by taxes. Providing water and electricity to a vast area, it dramatically improved lives and boosted the economy. So, while filling out tax forms may seem cumbersome, remember that taxes play a vital role in our society. They are more than just deductions on a paycheck, they are a civic duty, contributing to the betterment of our communities and nation.

Question 1

Why are taxes integral to a functioning society?

Taxes are a way to keep the population in check

Taxes are used to finance public goods and services

Taxes are a means for the government to exploit people

Taxes are only useful for the wealthy

Question 2

What event symbolizes the fight against unjust taxes by the British in the early foundation of the U.S.?

Independence Day

Boston Tea Party

The Civil War

The Manhattan Project

Question 3

What public works project, funded by taxes, provided water and electricity to a vast area and drastically improved lives and the economy when completed in 1936?

The Golden Gate Bridge

The Panama Canal

The Hoover Dam

The Empire State Building

Question 4

Which of the following is not a type of tax in the U.S.?

Income tax

Sales tax

Property tax

Health tax

Question 5

Why are taxes considered a civic duty?

Because they are used to pay politicians

Because they help increase government spending

Because they contribute to the betterment of communities and nation

Because they help increase personal savings

Because they reduce income inequality

or share via

or share via

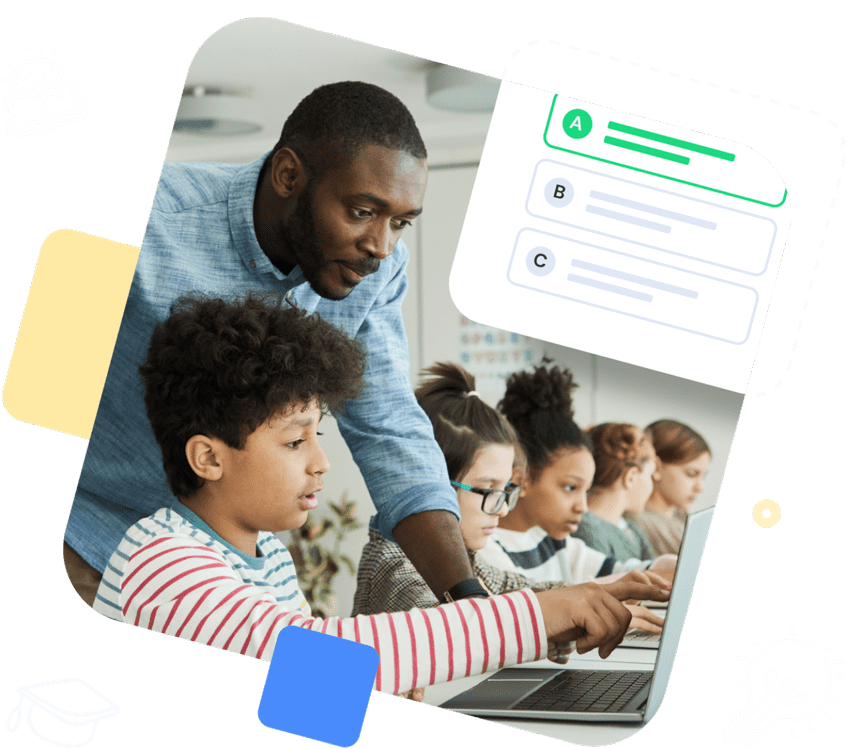

Assign the ReadTheory pretest to determine students' reading levels.

Why Teachers Love

Instant Worksheet Builder?

Tailored Content for Every Student

Craft worksheets with passages and multiple-choice questions customized to your chosen topic and grade level, ensuring relevance and engagement.

Save Hours

of Prep Time

Our AI, Lexi, generates complete worksheets—passages, questions, and answers—in minutes, freeing you to focus on teaching, not planning.

Standards-Aligned Learning

Every worksheet is designed to boost reading comprehension and critical thinking, aligning seamlessly with State Standards to help your students shine.

Personalized teaching

for personalized learning

Browse worksheets created and refined by educators using Lexi—your source for inspiration and ready-to-use resources.

ReadTheory is free for Teachers to use.

Join thousands of educators using ReadTheory for free. Sign up today and start creating in just minutes!