Transform Your Teaching

with AI-Powered Worksheets

With ReadTheory’s Instant Worksheet Builder, you can create engaging, grade-appropriate worksheets tailored to your students in minutes. Spark curiosity, save time, and empower critical thinking with AI-powered tools designed for teachers like you.

The Role of Financial Lenders in the Economy

Financial lenders are an integral part of the economic landscape, providing funds for a range of purposes. These institutions or individuals supply the lifeblood for economic growth by offering loans that facilitate education, business operations, and personal endeavors. There exists a vast array of financial lenders, including commercial banks, credit unions, and private investors. Each type of lender operates differently and provides services tailored to the diverse financial needs of their customers. Money lending is not a charitable act; lenders make a profit through the interest rates and fees charged on the loans they provide. An interest rate is a percentage of the loan that the borrower must pay back, in addition to the loan amount itself. By lending money and collecting interest, financial lenders stimulate economic growth. They give businesses the opportunity to invest in new ventures and individuals the chance to advance their education or fulfill personal needs. In conclusion, financial lenders play a critical role in the economy by enabling investment and expansion.

Question 1

What is the purpose of financial lenders?

To provide funds for education, businesses, and personal endeavors

To invest in the stock market

To donate to charitable causes

To provide insurance services

To manage retirement funds

Question 2

What does the term 'interest rate' refer to in the context of financial lending?

A percentage of the loan that the borrower must pay back in addition to the loan amount

The initial amount borrowed from a lender

The discount offered by lenders on large loans

The profit made by a lender from a loan

The income generated by a lender from non-loan services

Question 3

Why do financial lenders charge interest rates and fees on the loans they provide?

To make a profit

To secure their own finances against potential loss

To discourage borrowing

To fund their own operational costs

To contribute to government tax revenues

Question 4

What role do financial lenders play in the economy?

Enabling investment and expansion

Regulating inflation rates

Setting government fiscal policies

Directly creating jobs in the market

Controlling the stock market

Question 5

What is an example of a financial lender?

A commercial bank

A stock brokerage

A charity organization

A government treasury

A retail store

or share via

or share via

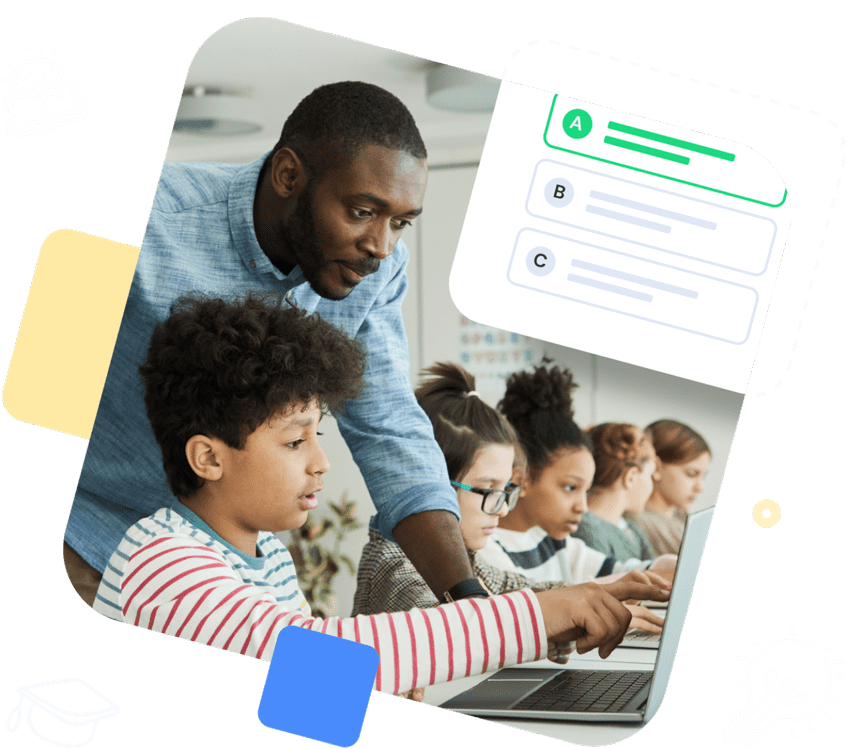

Assign the ReadTheory pretest to determine students' reading levels.

Why Teachers Love

Instant Worksheet Builder?

Tailored Content for Every Student

Craft worksheets with passages and multiple-choice questions customized to your chosen topic and grade level, ensuring relevance and engagement.

Save Hours

of Prep Time

Our AI, Lexi, generates complete worksheets—passages, questions, and answers—in minutes, freeing you to focus on teaching, not planning.

Standards-Aligned Learning

Every worksheet is designed to boost reading comprehension and critical thinking, aligning seamlessly with State Standards to help your students shine.

Personalized teaching

for personalized learning

Browse worksheets created and refined by educators using Lexi—your source for inspiration and ready-to-use resources.

ReadTheory is free for Teachers to use.

Join thousands of educators using ReadTheory for free. Sign up today and start creating in just minutes!