Transform Your Teaching

with AI-Powered Worksheets

With ReadTheory’s Instant Worksheet Builder, you can create engaging, grade-appropriate worksheets tailored to your students in minutes. Spark curiosity, save time, and empower critical thinking with AI-powered tools designed for teachers like you.

The Power of Money: From Coins to Economies

Money, a small word, holds immense power. From ancient times when people used to barter goods, we've evolved to create a standardized measure of value - money. Interestingly, did you know? The first coins were made around 600 B.C., and paper money originated in China during the Tang Dynasty! However, money is more than just coins and notes. It's a tool. A tool that, if used wisely, can open doors to numerous opportunities. That's why understanding money management at a personal level is essential. You may have heard about saving, spending, and investing. These are three pillars of personal finance. Saving helps you prepare for the future, spending wisely ensures you meet your needs and wants judiciously, and investing allows your money to grow. But each of our individual financial decisions doesn't only affect us. It also impacts the larger economy. The more we save and invest, the more resources are available for businesses to grow and create jobs. And the more we spend, the more demand we create for goods and services, which also fuels economic growth. So, the next time you hold a coin or a bill, remember - you hold a piece of history, a tool for your future, and a small but significant part of the economy. The power of money truly is immense!

Question 1

What was the initial form of exchange before money was made?

Trading animals

Using spices

Barter system

Sharing resources

Exchanging jewelry

Question 2

Which dynasty first used paper money?

Ming Dynasty

Qing Dynasty

Han Dynasty

Tang Dynasty

Song Dynasty

Question 3

What are the three pillars of personal finance?

Saving, Spending, Loaning

Investing, Spending, Lending

Saving, Investing, Spending

Saving, Borrowing, Spending

Investing, Borrowing, Lending

Question 4

What does 'judiciously' mean in the context of spending money?

Spending without thought

Spending on unnecessary things

Spending more than you earn

Spending wisely according to needs and wants

Spending all at once

Question 5

How do individual financial decisions impact the economy?

They do not have any effect

They only affect personal finances

They lead to inflation

They can influence economic growth and job creation

They cause economic depression

or share via

or share via

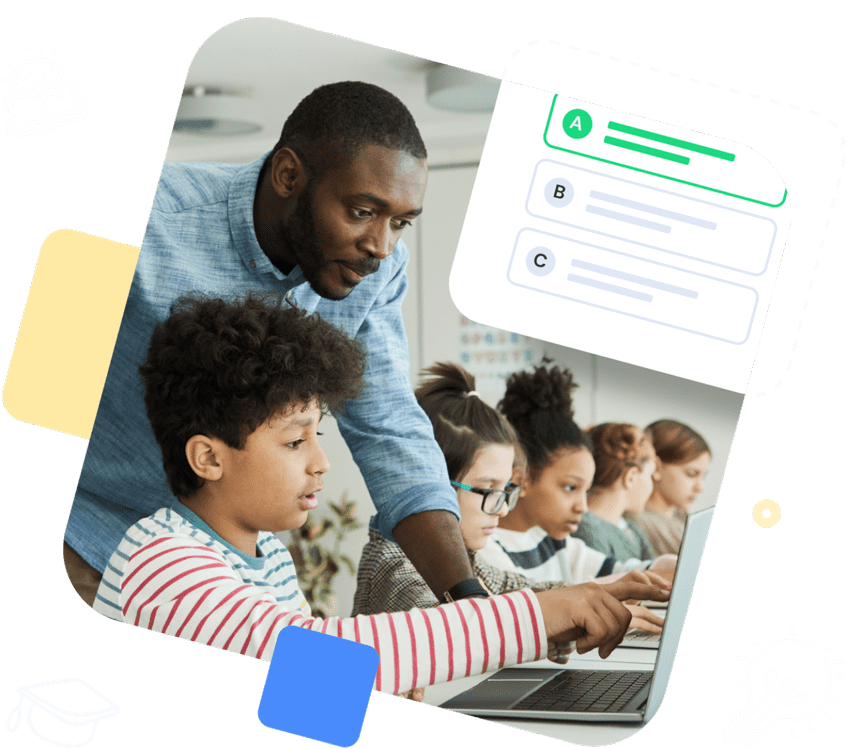

Assign the ReadTheory pretest to determine students' reading levels.

Why Teachers Love

Instant Worksheet Builder?

Tailored Content for Every Student

Craft worksheets with passages and multiple-choice questions customized to your chosen topic and grade level, ensuring relevance and engagement.

Save Hours

of Prep Time

Our AI, Lexi, generates complete worksheets—passages, questions, and answers—in minutes, freeing you to focus on teaching, not planning.

Standards-Aligned Learning

Every worksheet is designed to boost reading comprehension and critical thinking, aligning seamlessly with State Standards to help your students shine.

Personalized teaching

for personalized learning

Browse worksheets created and refined by educators using Lexi—your source for inspiration and ready-to-use resources.

ReadTheory is free for Teachers to use.

Join thousands of educators using ReadTheory for free. Sign up today and start creating in just minutes!