Transform Your Teaching

with AI-Powered Worksheets

With ReadTheory’s Instant Worksheet Builder, you can create engaging, grade-appropriate worksheets tailored to your students in minutes. Spark curiosity, save time, and empower critical thinking with AI-powered tools designed for teachers like you.

The Federal Reserve: A Stabilizing Force in the U.S Economy

The Federal Reserve, often just called the Fed, might seem like an abstract institution, but its decisions impact our lives every day. Established in 1913 in response to a series of financial crises, the Fed's mission is to provide the United States with a safe, flexible, and stable monetary and financial system. The institution serves as the central bank of the U.S., and its decisions influence everything from the prices we pay for goods to the rates we get on our savings accounts. One of the Fed's key responsibilities is controlling inflation. Inflation occurs when prices increase over time, and too much can erode buying power and destabilize the economy. The Fed uses several tools to control inflation, including adjusting interest rates and changing the amount of money in circulation. Another vital role of the Fed is acting as the bank's bank. Other banks keep their reserves at the Fed and borrow money from it in times of need. This system helps ensure that banks can meet their customers' withdrawal demands, which, in turn, helps maintain public confidence in the banking system. Finally, the Fed's decisions on interest rates can impact your personal budget. For example, when the Fed lowers interest rates, it becomes cheaper to borrow money, which can make it a good time to take out a mortgage or a car loan. In conclusion, though the Federal Reserve operates behind the scenes, its influence is felt by everyone. Understanding its functions can help us make informed decisions about our personal finances and appreciate the complex machinery that keeps the U.S economy running smoothly.

Question 1

What tool does the Fed use to control inflation?

Adjusting interest rates

Increasing taxes

Limiting imports

Printing more currency

Decreasing exports

Question 2

What happens when the Fed lowers interest rates?

It becomes more expensive to borrow money

Banks stop lending money

It becomes cheaper to borrow money

The value of the dollar increases

Inflation decreases

Question 3

How does the Fed help maintain public confidence in the banking system?

By printing more money

By ensuring banks can meet their customers' withdrawal demands

By lowering interest rates

By controlling inflation

By increasing taxes

Question 4

What was the primary reason the Federal Reserve was established?

To control inflation

To provide the United States with a safe, flexible, and stable monetary and financial system

To lower interest rates

To act as the bank's bank

To print money

Question 5

What is the result of too much inflation?

Increase in buying power

Stability of the economy

Erosion of buying power

Increase in interest rates

Decrease in the money supply

or share via

or share via

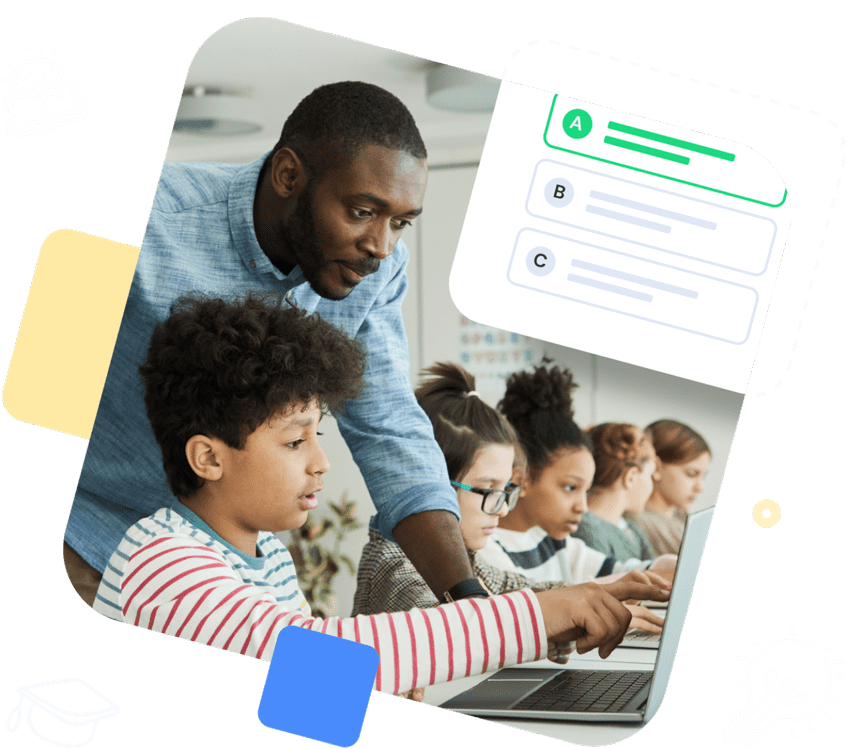

Assign the ReadTheory pretest to determine students' reading levels.

Why Teachers Love

Instant Worksheet Builder?

Tailored Content for Every Student

Craft worksheets with passages and multiple-choice questions customized to your chosen topic and grade level, ensuring relevance and engagement.

Save Hours

of Prep Time

Our AI, Lexi, generates complete worksheets—passages, questions, and answers—in minutes, freeing you to focus on teaching, not planning.

Standards-Aligned Learning

Every worksheet is designed to boost reading comprehension and critical thinking, aligning seamlessly with State Standards to help your students shine.

Personalized teaching

for personalized learning

Browse worksheets created and refined by educators using Lexi—your source for inspiration and ready-to-use resources.

ReadTheory is free for Teachers to use.

Join thousands of educators using ReadTheory for free. Sign up today and start creating in just minutes!