Transform Your Teaching

with AI-Powered Worksheets

With ReadTheory’s Instant Worksheet Builder, you can create engaging, grade-appropriate worksheets tailored to your students in minutes. Spark curiosity, save time, and empower critical thinking with AI-powered tools designed for teachers like you.

The Dance of Inflation and the Consumer Price Index

In the economic world, inflation is a significant player. Imagine buying a loaf of bread for $2 today, and a year later, the same bread costs $3. This price increase is essentially what we call inflation. Now, how do we calculate this rate of inflation? That's where the Consumer Price Index (CPI) comes into the picture.

The CPI is like a report card that tracks the change in price of a basket of goods and services over time. This basket can include everything from food and clothing to medical care and education. The CPI helps us measure the average change in prices paid by urban consumers for this basket, thereby giving us an idea of how much inflation is occurring.

The dance between inflation and the CPI is a critical one. As prices rise, the CPI increases, indicating inflation. But what causes this increase in prices, you ask? Various factors, such as changes in production costs, demand, and government policies, can influence inflation.

Inflation isn't just a number; it has real-life implications. When inflation rises, your purchasing power, the ability to buy goods and services, decreases. The $10 in your wallet can buy less bread if prices go up.

However, a moderate level of inflation is considered normal and even healthy for economies. It can stimulate spending and investment, which promotes economic growth. But runaway inflation? That's a different story and can be quite damaging.

In essence, understanding inflation and the CPI gives us a valuable tool to observe the economic health of a country. So the next time you buy a loaf of bread, remember the dance between inflation and the CPI!

Question 1

What is the Consumer Price Index (CPI)?

A measure of the average change in prices paid by urban consumers for a basket of goods and services

A measure of the total amount of goods and services produced by a country

A measure of the average income of a country's citizens

The interest rate set by the central bank

The national debt of a country

Question 2

What is the impact of inflation on your purchasing power?

It increases over time

It decreases over time

It stays the same

It is not affected by inflation

It fluctuates randomly

Question 3

Why is a moderate level of inflation considered healthy for an economy?

It stimulates spending and investment

It decreases the national debt

It increases the value of money

It decreases the cost of goods

It improves the balance of trade

Question 4

What are some factors that can influence inflation?

Changes in production costs, demand, and government policies

The weather

The political party in power

The level of education of the population

The amount of gold reserves a country has

Question 5

Why is runaway inflation damaging to an economy?

It can reduce the value of money to such an extent that it becomes problematic

It makes goods cheaper

It increases employment

It increases the country's exports

It helps pay off the national debt

or share via

or share via

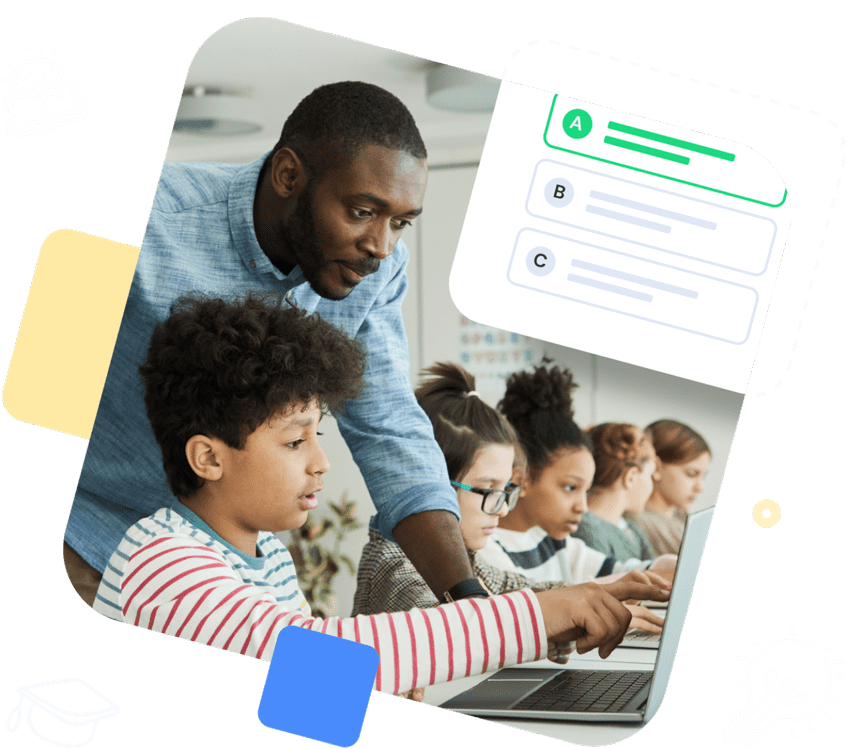

Assign the ReadTheory pretest to determine students' reading levels.

Why Teachers Love

Instant Worksheet Builder?

Tailored Content for Every Student

Craft worksheets with passages and multiple-choice questions customized to your chosen topic and grade level, ensuring relevance and engagement.

Save Hours

of Prep Time

Our AI, Lexi, generates complete worksheets—passages, questions, and answers—in minutes, freeing you to focus on teaching, not planning.

Standards-Aligned Learning

Every worksheet is designed to boost reading comprehension and critical thinking, aligning seamlessly with State Standards to help your students shine.

Personalized teaching

for personalized learning

Browse worksheets created and refined by educators using Lexi—your source for inspiration and ready-to-use resources.

ReadTheory is free for Teachers to use.

Join thousands of educators using ReadTheory for free. Sign up today and start creating in just minutes!