Transform Your Teaching

with AI-Powered Worksheets

With ReadTheory’s Instant Worksheet Builder, you can create engaging, grade-appropriate worksheets tailored to your students in minutes. Spark curiosity, save time, and empower critical thinking with AI-powered tools designed for teachers like you.

Master Your Money: Understanding the 50-30-20 Budgeting Rule

It's never too early to start thinking about how you manage your money. One popular method is the 50-30-20 rule, a simple yet effective budgeting technique. This rule divides your income into three categories: needs, wants, and savings.

Here's how it works. Imagine you earn $1000. According to the 50-30-20 rule, you'd divide this money as follows:

- $500 (50%) goes to needs - things you can't live without, like food, rent, or essential bills.

- $300 (30%) goes to wants - things you enjoy but could live without, like new clothes or eating out.

- $200 (20%) goes to savings or paying off debt.

This rule helps you avoid overspending and ensures you're saving money for the future.

But why should you, as a 10th grader, care about budgeting? Well, pretty soon, you'll be getting your first job, going to college, or even moving out. Learning to manage your money now will help you avoid financial stress in the future. Plus, it's a great way to start saving for big goals, like a car, college, or travel.

Want to give it a try? Start by tracking your spending for a month to see where your money is going. Then, divide your income or allowance according to the rule. Remember, it's okay if the percentages aren't exact at first- the goal is to start thinking about your spending and saving habits.

In summary, the 50-30-20 rule is a handy tool to manage your money wisely. So, why not give it a go? After all, mastering your money is another step towards becoming an independent adult.

Question 1

What does the 50-30-20 rule in money management signify?

50% to needs, 30% to wants, 20% to savings

50% to wants, 30% to needs, 20% to savings

50% to savings, 30% to wants, 20% to needs

50% to needs, 30% to savings, 20% to wants

50% to wants, 30% to savings, 20% to needs

Question 2

Why is it important for a 10th grader to learn about budgeting?

To avoid financial stress in future

To learn about math

To understand taxes

To start a business

To impress friends

Question 3

What should you do first if you want to apply the 50-30-20 rule?

Buy a car

Track your spending for a month

Open a bank account

Start a business

Invest in stocks

Question 4

What does 'overspending' mean in the context of budgeting?

Spending exactly as planned

Spending less than planned

Spending more than planned

Spending on unnecessary items

Not spending at all

Question 5

What is the benefit of the 50-30-20 rule?

It helps you spend more money

It helps you earn more money

It helps you avoid overspending and ensures savings for future

It helps you pay more taxes

It helps you invest in stocks

or share via

or share via

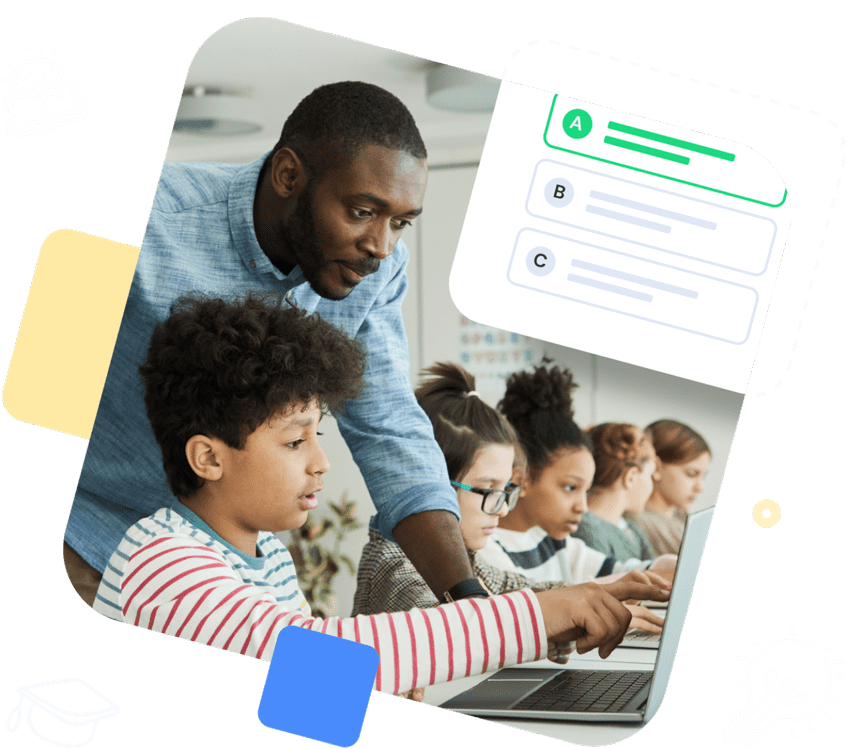

Assign the ReadTheory pretest to determine students' reading levels.

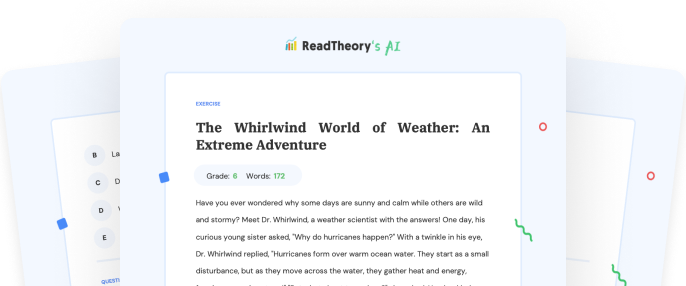

Why Teachers Love

Instant Worksheet Builder?

Tailored Content for Every Student

Craft worksheets with passages and multiple-choice questions customized to your chosen topic and grade level, ensuring relevance and engagement.

Save Hours

of Prep Time

Our AI, Lexi, generates complete worksheets—passages, questions, and answers—in minutes, freeing you to focus on teaching, not planning.

Standards-Aligned Learning

Every worksheet is designed to boost reading comprehension and critical thinking, aligning seamlessly with State Standards to help your students shine.

Personalized teaching

for personalized learning

Browse worksheets created and refined by educators using Lexi—your source for inspiration and ready-to-use resources.

ReadTheory is free for Teachers to use.

Join thousands of educators using ReadTheory for free. Sign up today and start creating in just minutes!